tax processing unit distraint warrant

- A local government unit may through its chief executive and acting pursuant to an ordinance exercise the power of eminent domain for public use or purpose or welfare for the benefit of the poor and the landless upon payment of just compensation pursuant to the provisions of the Constitution and pertinent laws. Authority to Search Vessels or Aircrafts and Persons or Goods Conveyed Therein.

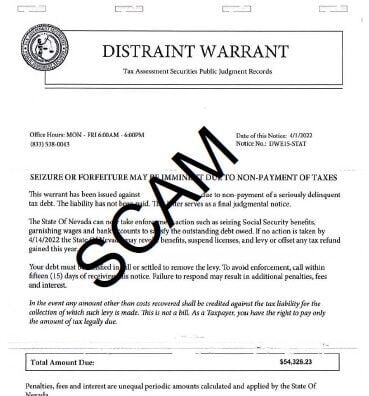

Scam Alert Buncombe County Officials Warn Of Fake Tax Processing Letters Wmya

Pleading and proof of contributory negligence assumed risk res ipsa loquitur consideration bona fide purchaser matters of judicial notice--Answer of distraint.

. 12169 Policy Statement 5-35 Establishment of minimum price in distraint sales. If a NFTL is only required on the mirrored tax periods against one spouse the case may be packaged with a completed NFTL request via Form 12636 Request for Filing or Refiling Notice of Federal Tax Lien and forwarded to SBSE CLO Liens Team 301 or eFax 855-390-3528 for processing. Provided however That.

Enter the email address you signed up with and well email you a reset link. ASCII A41 J4A K4B. In some cases the notices further claim the warrant serves the same function as a court judgment.

CIR CTA EB No 2124 CTA Case No. The Access Devices Law prohibits fraud committed in relation to an access device or any card plate code account number electronic serial number personal identification number or other telecommunications service equipment or instrumental identifier or other means of account access that can be used to obtain money good services or any other thing of value or to. Provided however That the.

D Capital Gains from Sale of Real Property. Search for a department and find out what the government is doing. Authority to Search Vessels or Aircrafts and Persons or Goods Conveyed Therein.

The letters say a Distraint Warrant has been filed and a lien will be placed on any property the taxpayer owns or acquires in the future unless they pay their tax debt in full. Residents are receiving letters purportedly from the Tax Processing Unit for Jackson County. Lispmit der Zunge anstoßen A-bombatomic bomb U-235 E.

A dwelling house may be entered and searched only upon warrant issued by a Judge of a competent court the sworn application thereon showing probable cause and particularly describing the place to be searched and the goods to be seized. The provisions of Section 39B notwithstanding a final tax of six percent 6 based on the gross selling price or current fair market value as determined in accordance with Section 6E of this Code whichever is higher is hereby imposed upon capital gains presumed to have been realized from the sale. Since the tax payments being sought to be refunded pertain to taxable year 2013 and BIRs RMC took effect on May 2 2013 the income earned are subject to income tax.

Distraint warrants are a legally enforceable means of ensuring future. Pleading and proof of written instruments. - The purpose of these Rules is to provide guidelines on the operationalization of the Philippine Clean Air Act of 1999.

- These Rules shall be known and cited as the Implementing Rules and Regulations of the Philippine Clean Air Act of 1999 Section 2. 1 In General. A local government unit may through its chief executive and acting pursuant to an ordinance exercise the power of eminent domain for public use or purpose or welfare for the benefit of the poor and the landless upon payment of just compensation pursuant to the provisions of the Constitution and pertinent laws.

Signing and verification of pleadings. A dwelling house may be entered and searched only upon warrant issued by a Judge of a competent court the sworn application thereon showing probable cause and particularly describing the place to be searched and the goods to be seized. Here is the first half of the English to Simple English dictionary.

Thus the taxpayers claim for refund was denied Lubag v. Inside the envelope is a letter with the header Distraint Warrant and informing the recipient of an unpaid tax debt. Scope - These Rules shall lay down the powers and functions of the Department of.

9306 December 1 2020. Therefore will not accept unsigned income tax returns for processing although these returns may constitute informal claims for refund or credit if the taxpayers report overpayments of tax on the returns. Theres no such department.

The rules should operate prospectively. If in the opinion of the examining officer the.

Fraudulent Tax Debt Letters Claiming Distraint Warrant Are A Scam Randall County Says

Fake Tax Warrarnts Warning Fake Tax Lien Warrants Received In Larimer County

Scam Susquehanna Susquehanna County Sheriff S Office Facebook

Scam Alert Buncombe County Officials Warn Of Fake Tax Processing Letters Wmya

Watch Out For Tax Processing Unit Scam Beacon Tax Services

Tax Department Warns Of Fraudulent Notice Crime And Courts Elkodaily Com

Mark Poloncarz On Twitter Watch Out For This Scam If You Receive A Letter Like The One Pictured Below Please Notify The Erieocp More Info Https T Co 339yvzhale Twitter

Scam Alert Lincoln County New Mexico

Randolph County Officials Warn Of Scam From Tax Processing Unit

Scam Alert Have Hamilton County Sheriff S Office Tn Facebook

Idaho State Tax Commission Tax Scam Alert Beware Of A New Tax Scam That Comes By Mail An Individual With A Tax Debt Recently Received A Distraint Warrant For Payment Of

Scam Alert Fraudulent Tax Letters Claiming Distraint Warrant Cattaraugus County Website

Sharing Important Tax Scam Painesville Police Department Facebook

Distraint Warrant Tax Processing Unit Erie County Public Judgment Records Consumer Protection