maricopa county tax lien foreclosure process

Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the. All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St.

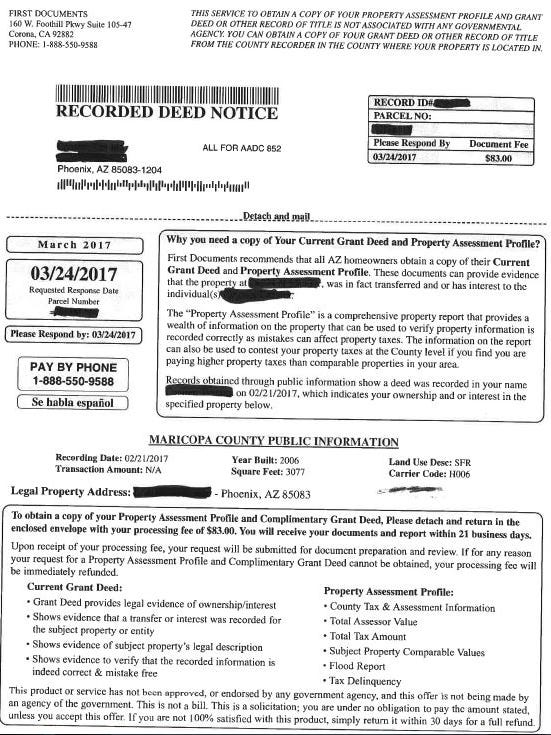

Maricopa County Homeowners Watch Out For This Property Deed Scam

That cost varies depending on the type of property involved but normally is between 300 to 550.

. There are currently 11375 tax lien-related investment opportunities. At least 30 days but not more than 180 days after mailing the Notice of Intent to File Foreclosure Action to the property owners and the Mohave County Treasurer take or mail the filing fee. The first installment is one-half of the taxes on real and personal property due on October 1st and.

Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer. In Maricopa county they pay up to 16 of tax lien certificates. Maricopa County Treasurer Attention.

The current years taxes due can be paid in full before December 31st without late fees. Find the best deals on the market in Maricopa County CA and buy a property up to 50 percent below market value. Maricopa County AZ currently has 18390 tax liens available as of October 5.

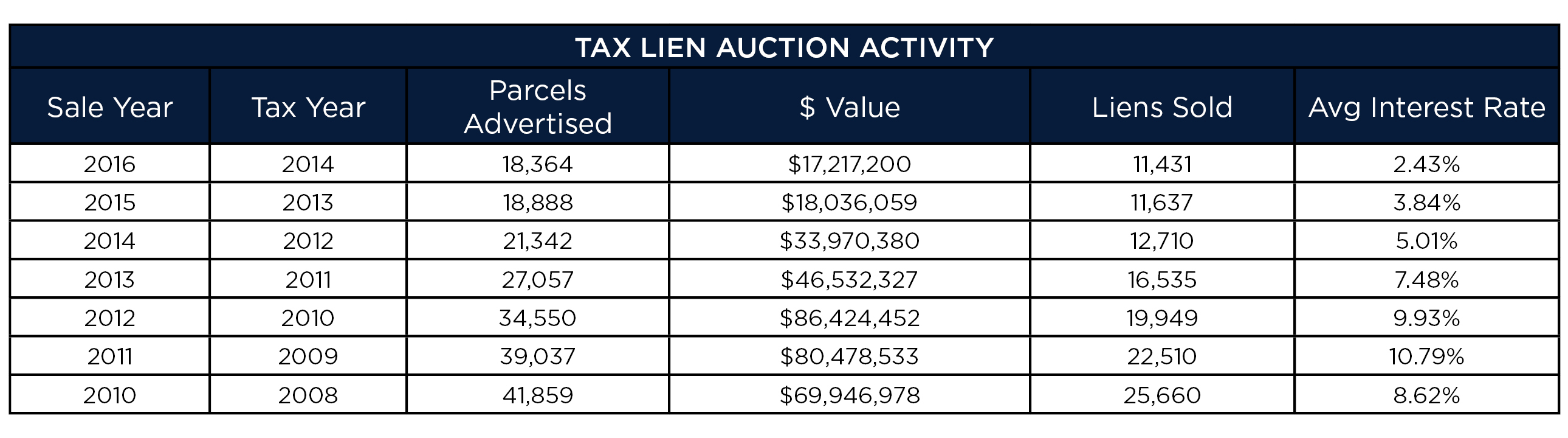

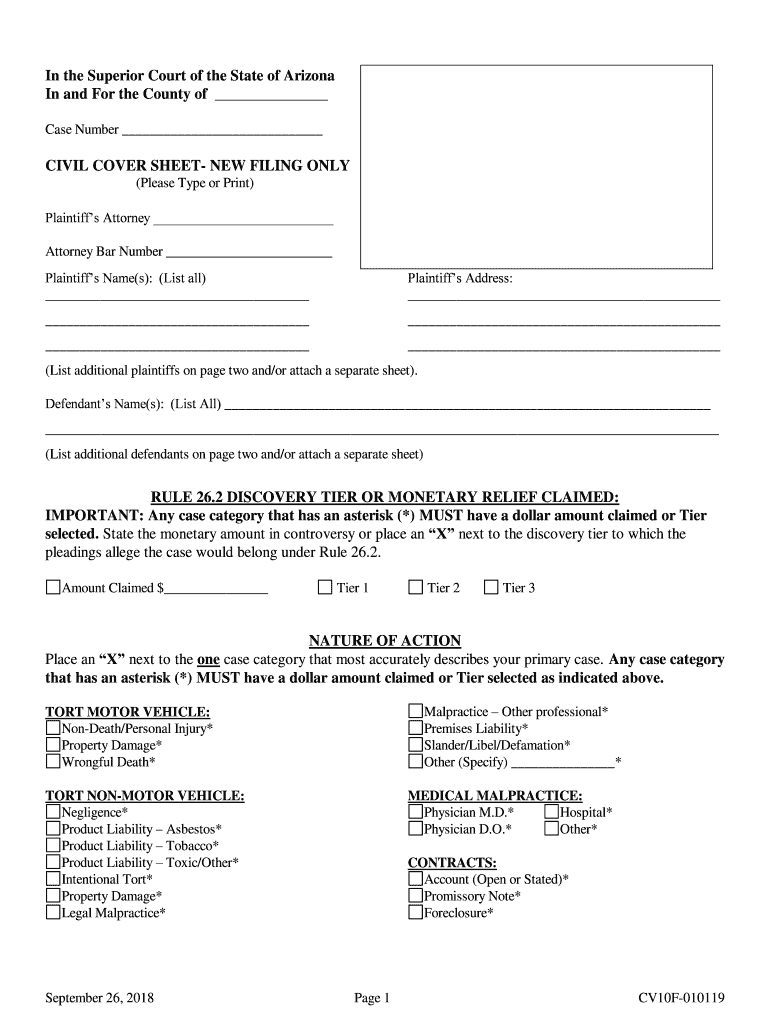

Any certificate holder including the County may file an Action to Foreclose in the Superior Court of Maricopa County three years from the date of the sale. However if I want it I could bid 15 and a half. The interest rate paid to the county on delinquent taxes is 16.

All groups and messages. Map More Homes in Scottsdale. However since the early 1990s.

Maricopa County County AZ tax liens available in AZ. Baumann Doyle Paytas Bernstein PLLC. Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value.

Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including. Tax Deeded Land Sales. When a lien is auctioned it is possible for the bidder to achieve that rate too.

Offers a full range of legal services concerning tax lien foreclosure actions. E Mcdowell Rd Ste 122. Jefferson Street Suite 140 Phoenix AZ 85003-2199 Please use the format below when submitting a purchase request.

Shop around and act fast. There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available for sale or worth pursuing. Coconino County 219 East Cherry Avenue Flagstaff AZ 86001 Phone.

What is the tax deed process. Except Federal Holidays Customer Service. Securing a tax lien against real estate for.

If you raise your hand and say 16 thats where it all starts. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Maricopa County CA tax liens available in CA.

HUD VA and Tax Sales AZ Tax Lien Foreclosure Feb 16 2020 1647. Tax Lien Department 301 W. You need to do this to make sure you obtain good title through the foreclosure.

So the first bid is 16.

A 2016 Update Maricopa County Treasurer

Displaced In America Housing Loss In Maricopa County Arizona

Fill Free Fillable Forms Maricopa County Telecommunications

Residential Rentals In Maricopa County Must Be Registered The Arizona Report

Arizona Tax Lien Sales For 2013 The Rules And Laws

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Arizona Officials Detail Plan For Public Safety During Election 12news Com

A Conversation With Charles Hos Hoskins Former Maricopa County Treasurer

How To Buy Tax Liens In Maricopa County Youtube

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Maricopa County Deed Of Trust Form Arizona Deeds Com

2018 2022 Form Az Cv10f Fill Online Printable Fillable Blank Pdffiller

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate

Maricopa County Treasurer S Office John M Allen Treasurer

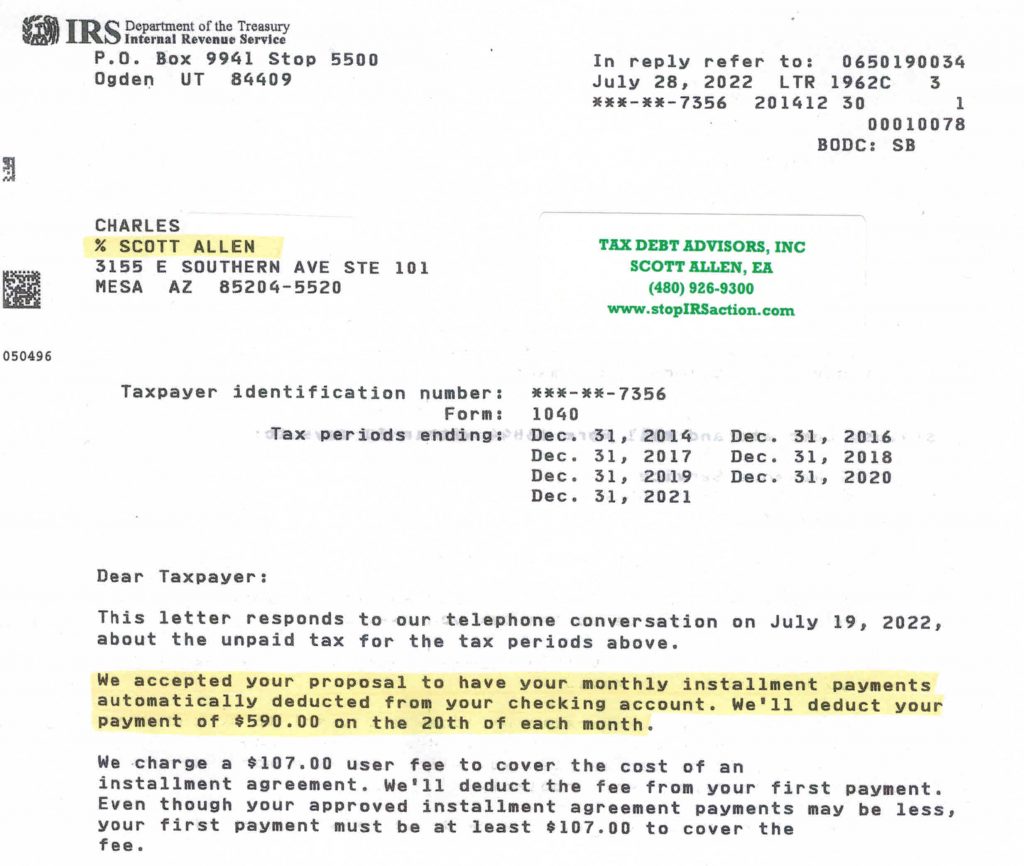

Irs Tax Lien Problems Tax Debt Advisors

Arizona Tax Liens Maricopa County Tax Lien Research Tutorial